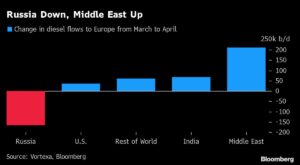

Middle Eastern petrostates are helping Europe so that they can make up for a fall in diesel supplies from Russia.

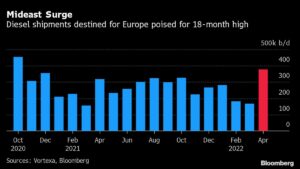

According to fixture reports and tanker tracking data compiled by Bloomberg, flows of the transport fuel from the Persian Gulf to Europe are set to rise almost 130% this month to 379,000 barrels a day.

According to the provisional bookings data, that’s the highest figure since October 2020 and will be bigger than the 166,000 barrel-a-day fall in European imports from Russia.

As per the data for this year of Europe, the prices of power trucks, heavy machinery, and ships have surged around 70 percent in 2022. That is even more than crude, which jumped by more than $100 a barrel in the wake of Russia’s attack.

The so-called crack spread for diesel — a measure of the profitability for refining crude — has increased from $11 a barrel at the start of 2022 to more than $40.

That’s giving countries such as Saudi Arabia and the United Arab Emirates (UAE) an encouragement to increase diesel exports.

The two OPEC members are known as swing producers for their ability to ramp up crude output. But after more than a decade of expanding refining capacity and building their trading arms, they’re now playing a similar role in refined fuel markets.

According to Bloomberg calculations, the diesel flows may generate Middle Eastern producers around $1.5 billion in revenue over this month based on current prices.

Diesel stockpiles worldwide fell heavily last year as demand recovered from the worst of the coronavirus pandemic, and the trend’s accelerated since the Ukraine war started. The issue could worsen in the upcoming months as more long-term Russian supply contracts expire and traders refuse to extend them, said Matt Stanley, a Dubai-based broker at Star Fuels.

The data report in which it clearly states that Russia will still be the largest diesel supplier to Europe this month, with discharges averaging 618,000 barrels a day, according to the data.