Dubai: Foreign investors tended to buy in the Dubai Financial Market, with a net investment of 70.2 million dirhams, in yesterday’s session, after making purchases worth 187.4 million dirhams, compared to sales of about 117.2 million dirhams.

Yesterday, local stocks attracted liquidity of about 1.28 billion dirhams, distributed by 974.65 million dirhams in the Abu Dhabi market and 309.5 million dirhams in the Dubai market, and about 272.9 million shares were traded through the implementation of 21.2 thousand transactions.

The market capitalization of listed stocks recorded about 3.53 trillion dirhams at the end of yesterday’s session, distributed by 2.844 trillion dirhams for shares in the Abu Dhabi Securities Market and 686.7 billion dirhams for shares in the Dubai Financial Market.

3 stocks acquired more than half of the liquidity of the Dubai Financial Market, namely “Emaar Properties”, “Gulf Navigation” and “Emirates NBD”, in yesterday’s session, the first session of the week, with liquidity exceeding 171.2 million dirhams, or 55.3% of the total market liquidity. , amounting to 309.5 million dirhams.

The Dubai Financial Market index held steady at the end of yesterday’s trading session, supported by the shares of “Emaar Properties” and “Dubai Islamic”, coinciding with the rise of the real estate sector index by 0.14%, and the index closed at 4068.65 points, down by 0.52%.

The shares of “Emaar Properties” and “Gulf Navigation” topped the Dubai Financial Market, recording a liquidity of 134 million dirhams, at the end of yesterday’s session, and the two shares closed at 7.13 and 7.01 dirhams, respectively, and the shares of “Emaar Properties” and “Bank” came.

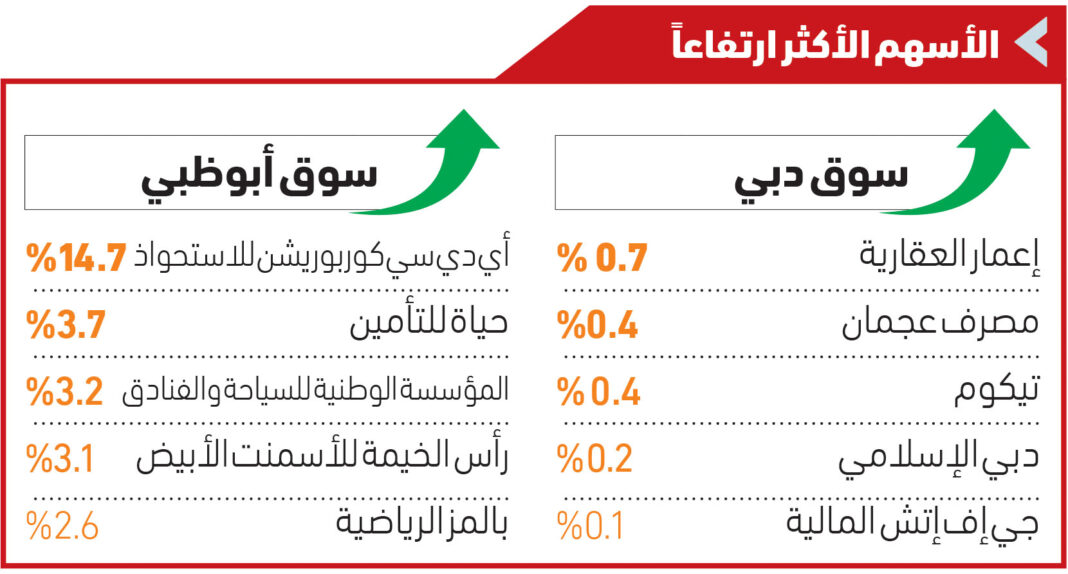

Ajman in the forefront of the rises of 5 stocks in the Dubai market, rising 0.7% and 0.4%, respectively. In the Dubai market, Tecom shares rose 0.4%, Dubai Islamic rose 0.2%, and GFH Financial rose 0.1%.

The FTSE index closed the Abu Dhabi General Market «Fadji» at the level of 9748.23 points, down by 0.39%. The market witnessed an increase in the shares of ADC Corporation for acquisition by 14.7%, Hayat Insurance by 3.7%, the National Corporation for Tourism and Hotels by 3.2%, and Ras Al Khaimah White Cement by 3.1%. Palms Sports 2.6%.

Abu Dhabi National Insurance increased by 2.5%, Abu Dhabi National Hotels increased by 1.6%, International Holdings increased by 0.2%, and Alpha Abu Dhabi Holding increased by 0.2%.

The share of “Al-Alamiya Holding” won the largest share of the Abu Dhabi market’s liquidity, at about 209.55 million dirhams, followed by “Multiplay” with a liquidity that exceeded 120.3 million dirhams, then “Alpha Abu Dhabi Holding”, which attracted 101.2 million dirhams.